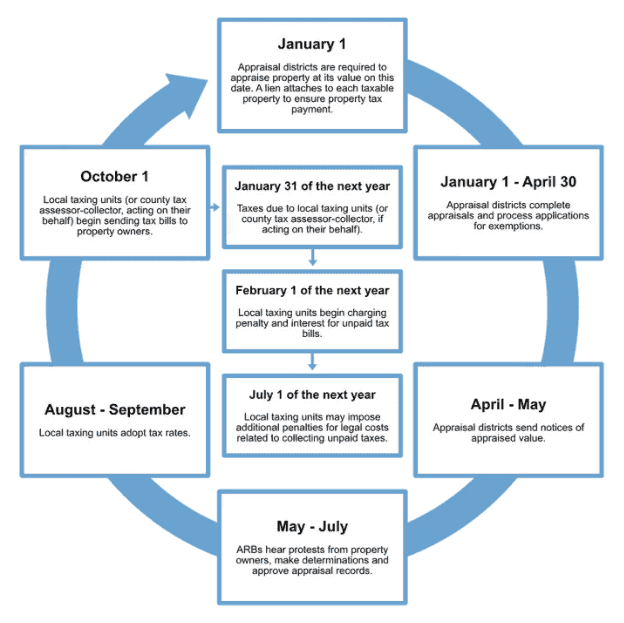

We all know that taxes can be a headache. Tax rates, deadlines, exemptions, where do you start? Here are some tips on calculating taxes to make taxes a little easier this year, specific to Harris County.

Before you can figure out how much you owe, it helps to understand a few key terms used in property tax calculations:

Property market value: Estimated worth or price at which a property can be bought or sold in the Texas real estate market.

Property appraised value: Assessed or estimated value or a property, as determined by a professional property appraiser or by the local county appraisal district

Factors of Appraisal Price:

Location of residence

Condition of home

Size of home

Recent Sales of Similar Homes

How to Protest Appraised Value:

You will receive your “Notice of Appraised Value” in the spring. The deadline for protesting your home’s appraised value is 30 days after receiving notice. File your complaint with the County Appraisal District (CAD). For the Harris Central Appraisal District (HCAD), Click here.

After appraisals are set, local entities such as school districts, cities and Municipal Utility Districts (MUDS) set their tax rates. Expect your bill by the end of October and be sure to pay the bill by the end of January.

Tax Bill Formula

(Home Appraised Value – Exemptions) ÷ 100 × Tax Rate = Your Bill

Note: Ricewood MUD does not provide a homestead exemption. However, the Harris Central Appraisal District (HCAD) applies an annual appraised value cap to homesteaded properties in their second year of ownership. This cap limits the appraised value increase to no more than 10% per year, based on the previous year’s appraised value. For example:

- Year 1 appraised value: $100,000

- Year 2 cap: $110,000

- Year 3 cap: $121,000

If your property’s market value exceeds the cap, your taxes are calculated on the capped value, not the full market value. If the market value is below the cap, your taxes are based on the full market value.

Texas Exemptions: At the beginning of the year, the Board of Directors reviews and grants exemptions for the current year. Presently, Ricewood MUD has a $60,000 exemption for homestead Residents who are 65 and over or disabled.

65 and Older Exemption: A homeowner who turns age 65 or who becomes disabled during a tax year, will qualify immediately for those exemptions, as if the homeowner qualified on Jan. 1 of the tax year. A surviving spouse age 55 or older may qualify for the deceased spouse’s exemption, if the spouse dies in the year that he or she reaches age 65. A disabled veteran or their surviving spouse whose home was donated by a charitable organization, the surviving spouse of a U.S. armed services member killed or fatally injured in the line of duty and the surviving spouse of a first responder killed or fatally injured in the line of duty also qualify immediately for those exemptions, as if they qualified on Jan. 1 of the tax year.

Doing your taxes can be easy this year. You don’t have to do it alone. There are many resources available to you as a home or property owner. Contact HCAD for more information regarding taxes and appraisal value.